Make a Cash Envelope System

I’ve been using the Cash Envelope System for the past month and it has been a retro cash adventure. I’d forgotten what it was like to carry cash in my wallet and spend it according to a budget plan. It was like going back in time to 1989.

Unless you’ve tried this already you will be surprised by how many cashiers in this day and age are unfamiliar with the green stuff in your envelope as well as the places where cash simply doesn’t work. In the beginning it was both awkward, annoying and at times, funny.

I should also tell you that my husband just kind of looked at me strangely when I said I wanted to do this and why. He wasn’t thrilled. But I promised him something that made it easier for him to agree to try it. I’ll tell you what that is later in this article…

Choosing to Create an Envelope System

I chose to make an Envelope Budget because my discretionary spending (groceries etc.) had gotten a bit out of hand and I always seemed to have too much month left at the end of my money. So separating the discretionary money in my budget into categories seemed like a reasonable diagnostic. I just wanted to investigate a little into my own habits with the debit card which had become nothing more than an unconscious swipe at the cash register.

At our house we already have a healthy habit of keeping the regular bills in a separate account from spendable money so that there is zero problem with nibbling at the bills money for ‘wants’. It’s a suggestion that I highly recommend; keep discretionary money and bills money in two separate banks accounts. Don’t use the bill account for discretionary spending at all – just bills. I love keeping different categories of money from touching each other, kind of like a kid who doesn’t want their peas and carrots to touch on the dinner plate.

This leads me back to the Envelope Budget. It’s not like I’d never done this before. My husband and I used a cash system as newlyweds. So it should be a piece of cake, right? Well, not exactly.

Setting up a Cash Envelope Budget

Setting up an Envelope Budget takes a little thought and organization. Here’s what I did:

-

Look over your current spending cash budget honestly and write a new one even if the changes you make aren’t that big. This may help you see your money a new way.

In doing this I realized I hadn’t made changes to the household budget for about eight years! I shifted funds a bit between categories that had changed over the years. There was no category for gifts which I realized was blowing a hole in my budget frequently. Another realization was that I was depending on my emergency funds for car maintenance. So now ‘gifts’ and ‘car maintenance’ have envelopes of their own. This brings us to #2. Categories.

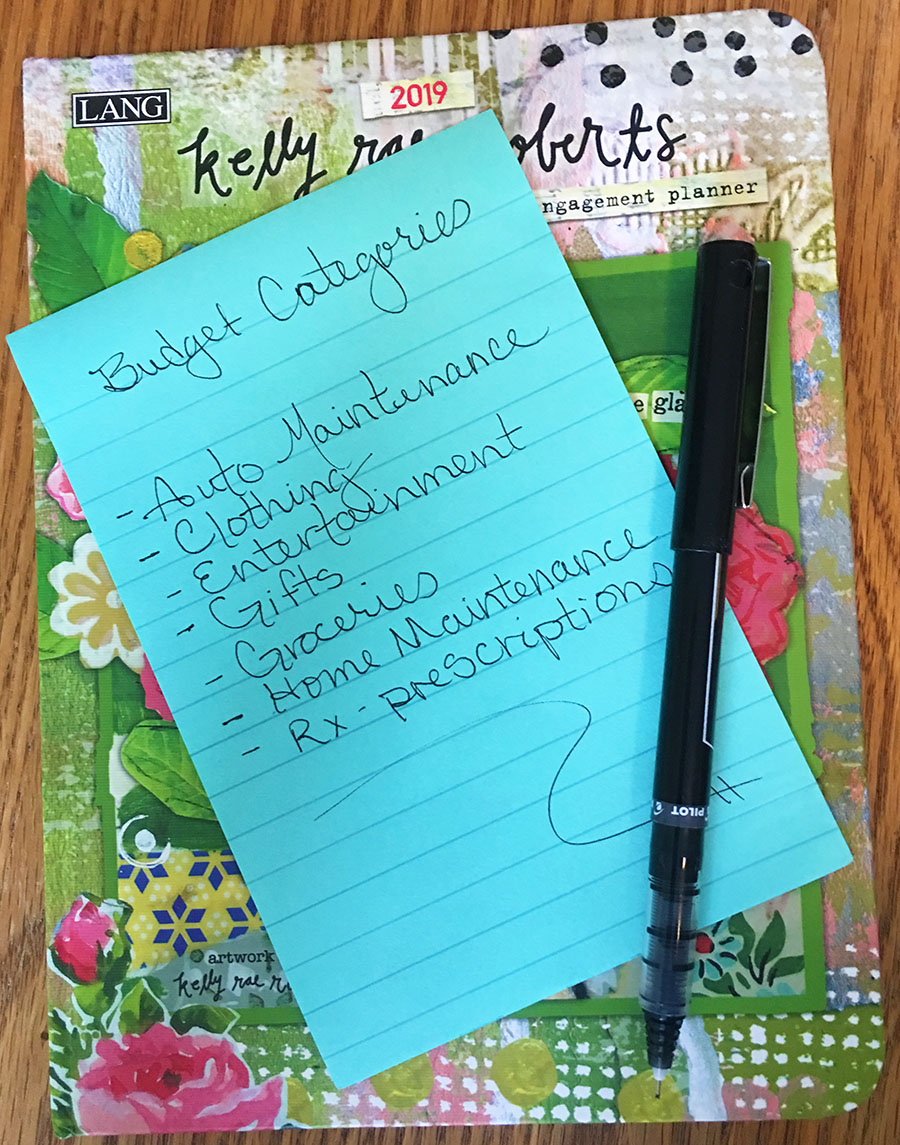

2. Decide what categories you need for your cash envelopes.

These should reflect the discretionary budget you made in #1 above.

My current envelopes are:

- Auto Maintenance (*sinking fund)

- Clothing (*sinking fund)

- Entertainment

- Gifts

- Groceries

- Home Maintenance (*sinking fund)

- Rx – prescriptions

Other category suggestions: Restaurant, Health, Grooming /Hair, Allowance, Gas, Christmas, vacations, emergency fund, etc. We all have varying category needs. Please add category suggestions in the comments below.

*Sinking funds: This is actually a financial term often used in regard to paying off a debt or bond. In this case it refers to holding over funds toward a goal (like Christmas or School Supplies) or holding money over in an envelope month to month until it’s needed, ie, auto maintenance or emergency fund.

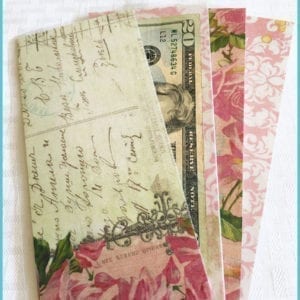

3. Stuff Your Envelopes.

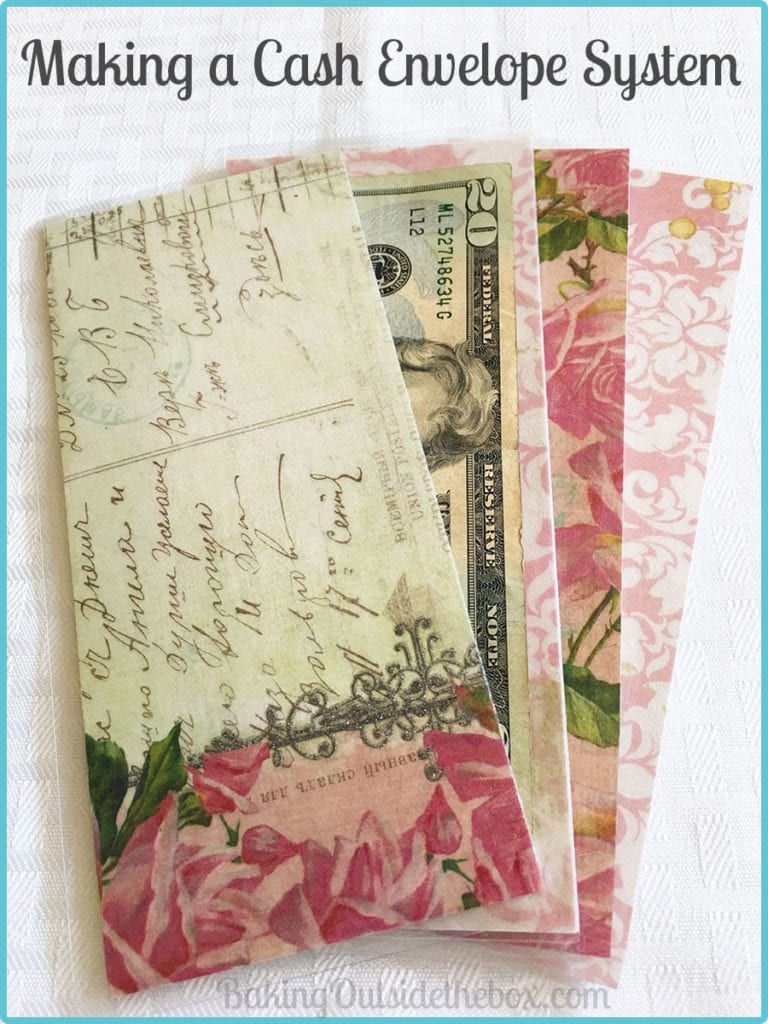

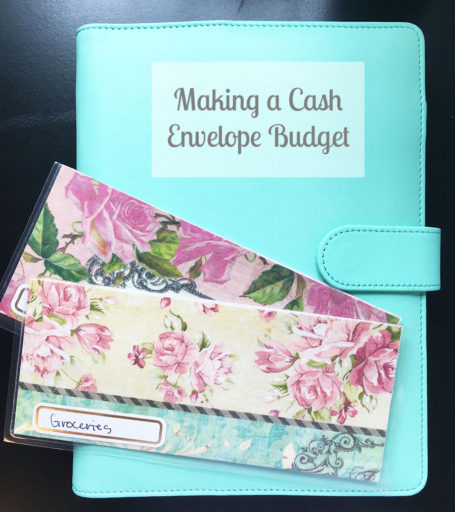

- Use any kind of envelopes you like. I started out with the cheap white paper ones as a newlywed and they work just fine. This time I made a set of scrapbook paper envelopes that I laminated, and labeled and they fit well in a wallet I bought at Walmart. The envelopes should be 7″-7 1/2″ inches long for the money (US) to fit in smoothly. The wallet I use is about 8 inches wide.

- When should you stuff your envelopes? I stuff mine when we get a paycheck, which is twice a month. Break down your spending budget according to how frequently you are paid. Stuff the envelopes accordingly.

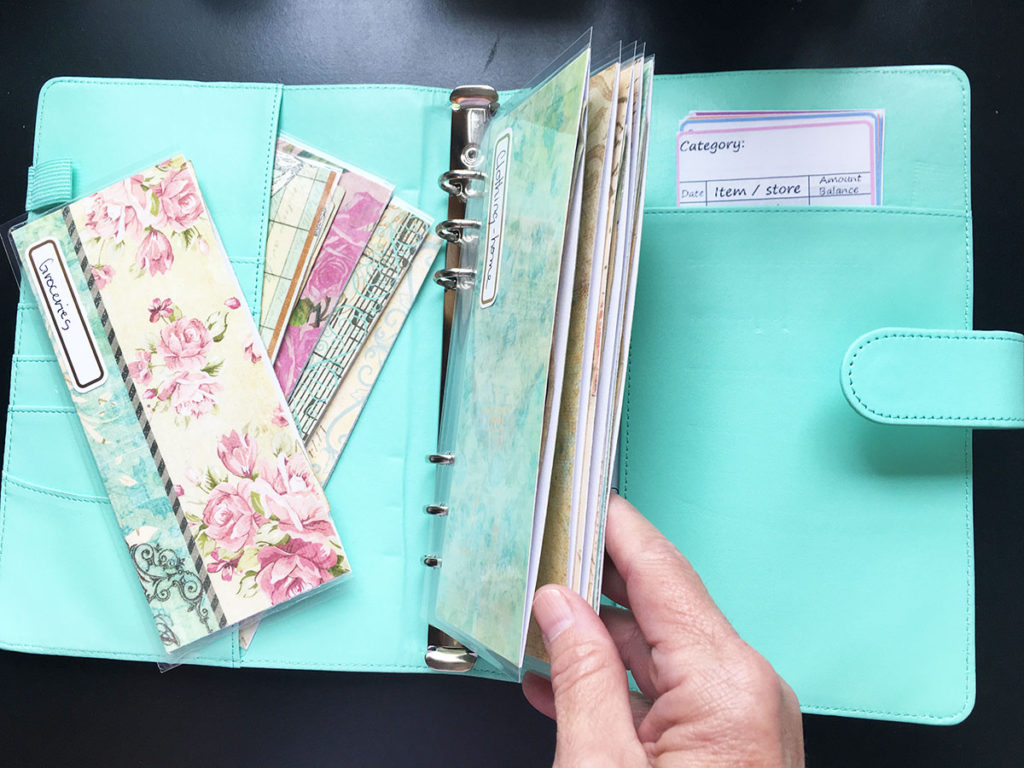

- Try this if you get paid biweekly, twice a month or monthly: I have two identical sets of envelopes. One for the present week and another that I leave at home which is set up for the second week. I like to keep my cash in weekly allotments. Depending on how you are paid, you might be keeping more than a week’s worth of money in the second set of envelopes. If you are paid weekly, then, lucky you, you can skip this step.

4. Ready, Set, Spend! – or Not.

With your envelopes stuffed and ready to go there are just a few more things to consider:

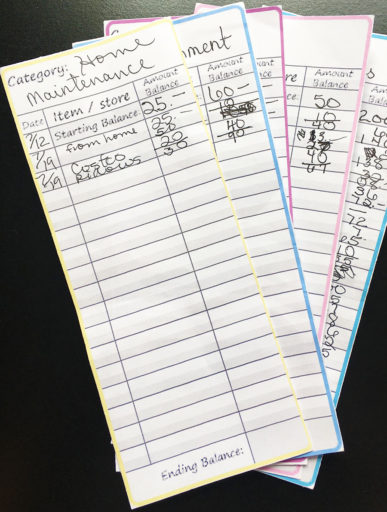

- Consider filling out a cash tracker, like the one I made, as you spend. This way you can see how much cash you have in any particular envelope at a time and you won’t have to ‘flash your cash’ to find out how much is in there. (I’m making these available as my gift to you for your personal use. The free download is at the bottom of this article.)

- Keep the receipts for your transactions in the back of your cash envelope until you have time to record them on your tracker. Then slip the recorded receipt into an envelope that contains all of the month’s receipts.

- Take only the envelopes in your wallet that you will need for each spending trip. I don’t know about you, but I don’t like carrying around more cash than I have to.

- I keep the current week’s envelopes that are either empty or stuffed, but not in use, in a planner with the secondary set of envelopes, extra cash trackers and monthly receipts. The very inexpensive planner I use is an A5 size that I purchased on the ‘Wish’ app. It took 3 weeks to arrive and does the job well. 🙂

- You should consider a sturdy lock box or safe that you can tuck away to keep your stuffed envelopes in.

- You need to come up with a plan to deal with coins. Here is the article about how I dealt with the coins I received in change.

How did this month go for me using the Envelope Budget? Better than imagined.

The first week or so was awkward.

- I spilled coins all over the floor at the grocery store.

- A cashier stared into space waiting for me to swipe my card as I tried to get his attention to pay in cash.

- A cash tracker form became essential after forgetting how much money was in my grocery envelope and why. See the bottom of the article for the free cash tracker download.

- My wallet bulged with the bulk of all the cash envelopes.

- I got better at keeping the various denominations of cash in order after I accidentally ‘flashed my cash’ at the store and then realized what I was doing. – Not smart!

- Two of the places I went don’t take cash: The doctor’s office and the Costco gas station.

The second half of the month got smoother.

- Having a plan to deal with change and tracking how much money was in the envelopes made things easier.

- Leaving the envelopes home that I would not be using for a specific errand was a relief to both my mind and the snap on my wallet.

- I realized I was becoming more meticulous in not making impulse buys as it really is harder to let go of the green stuff than swipe my debit card.

- Searching for sales and coupons before leaving the house became a habit. (Here’s an article on the apps I use.) This included deals at restaurants too. (Check out my coupon article here.)

- Having a planner helped keep things organized as well as having a special place for the unspent cash was a load off my mind.

What did I promise my husband a month ago that helped him reluctantly agree to try this system?

It’s diabolically simple. I promised him that whatever we had leftover at the end of the month (except sinking funds), we’d split as ‘blow’ money. He said, ‘What’s blow money?’ I explained that it’s money that you can BLOW on on whatever you want! He smiled and told me it was ok if I wanted to try it. I could tell he was at least intrigued, if not totally convinced.

He was quite tickled to get ninety bucks of blow money this morning after breakfast. The amount of the blow money was much more than either of us imagined. I’d even surprised myself. My darling says he’s going to spend it at the Legos store…. Enjoy! Laura

Download your free copy of my Envelope Budget Cash Trackers here: (Click on image.)

Inspirations:

Hi there we’re really just trying to get out of debt and be financially.stable free from every debt in every way.

Diane, I wish you all the best in your endeavors to become debt free. A cash envelope system can be a good tool to keep spending in check. One tip I used that helped us when we used to have credit cards: Before refilling the envelopes, I’d put any extra cash left in the envelopes back in the bank and use it to make an extra payment (no matter how small) towards the debt with the smallest balance. I highly recommend Dave Ramsey’s site. It has a lot of good information.